summit county utah sales tax

Tax rates are provided by Avalara and updated monthly. Major sections of the.

The Taxman Cometh Choose Park City Real Estate

Summit County Home Page.

. The County sales tax. Summit County UT Sales. The restaurant tax applies to all food sales both prepared food and grocery food.

The following documents give cross-listings of Utahs cities towns counties and entity codes for sales and. UT Rates Calculator Table. The calculator will show you the total sales tax amount as well as the county city and.

Publication 56 Utah Sales Tax Info for Lodging Providers. How Does Sales Tax in Summit County compare to the rest of Utah. The Summit County Utah sales tax is 655 consisting of 470 Utah state sales tax and 185 Summit County local sales taxesThe local sales tax consists of a 135 county sales tax and.

The sales tax numbers are estimates based on the l local option tax that is assessed in Park City. The 2022 Summit County Tax Sale will be held online. Look up 2022 sales tax rates for Summit Utah and surrounding areas.

Some taxes that Utah has include ones on consumer use rental cars sales sellers use lodgings and many others. This rate includes any state county city and local sales taxes. 274 rows Washington County.

Cities or towns marked with an have a local city-level sales tax. Publication 25 Sales and Use Tax General Information. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and.

The average cumulative sales tax rate between all of them is 778. 67 of the Utah Code Annotated and forwarded to the Utah State. Beer Alcohol Licensing.

The tax rate is determined by all the taxing agencies-city or county. Streamlined Sales Tax SST Training Instruction. All Tax Commission Publications.

As far as other cities towns and locations go the place. The minimum combined 2022 sales tax rate for Summit Park Utah is. The analysis does not deal with the Resort Community Tax 11 or the Citys Transit Tax.

Summit County Utah Recorder-4353363238 Assessor. Utah City and Locality Sales Taxes. Bids Request for Proposals.

This collection consists of papers and plats generated as wells as maps and other research materials gathered by Richard E. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. If you do not have a Utah sales tax licenseaccount report the use tax on line 31 of TC-40.

Ad Find Out Sales Tax Rates For Free. Access Utah sales and use tax rates on the Utah State Tax Commissions website. Bars and taverns in Utah are also subject to restaurant tax on food sales and beverages including beer.

You can find more tax rates and allowances for Summit County and Utah in the 2022 Utah Tax Tables. Deadline for 2022 Tax Relief Applications. Additional Information Contact the Tax.

Tax rates are also available online at Utah Sales Use Tax Rates or you can. The 2018 United States Supreme Court decision in South Dakota v. Rates include state county and city taxes.

You can use our Utah Sales Tax Calculator to look up sales tax rates in Utah by address zip code. The Utah state sales tax rate is currently. 2020 rates included for use while preparing your income tax deduction.

According to Sales Tax States 61 of Utahs 255 cities or. The Utah sales tax rate is currently. You may register as a bidder for the tax sale by visiting this link.

Manage Summit County Funds. Access county bids and. The total sales tax rate in any given location can be broken down into state county city and special district rates.

The most populous location in Summit County Utah is Park City. 2020 rates included for use while preparing your income tax deduction. Fast Easy Tax Solutions.

Redden engineer and geologist. This is the total of state county and city sales tax rates. 91 rows This page lists the various sales use tax rates effective throughout Utah.

Summit county utah sales tax rate Sunday May 8 2022 Edit. Important Property Tax Dates. 2022 Property Tax Due Date.

Utah has a 485 sales tax and Summit County collects an additional. The Summit County sales tax rate is. Missouri has state sales.

The amount of taxes you pay is determined by a tax rate applied to your propertys assessed value. The latest sales tax rates for cities in Utah UT state.

Venues Summit County Summit County Ohio Map Ohio

Colorado Summit County Tourism Industries Face Long Hard Road To Recovery Summitdaily Com

Summit County Utah Republican Party

Park City Utah Police Blotter Summit County Sheriff Reports Townlift

Pin By Meredith Dawn Kramer On Travel Hubs In 2021 Ski Area Deer Valley Park City

Summit County Adds Jobs In March But Unemployment Rate Not Fully Recovered From Pandemic

Arrest Made In Summit County Murder Investigation

Summit County Treasurer S Office Mails Property Tax Notices Summitdaily Com

National Level Real Estate Forecast Real Estate Real Estate Information Real Estate Prices

Summit County Can T Lower Property Taxes For Owners Who Rent Long Term To Locals Summitdaily Com

2022 Best Places To Live In Summit County Ut Niche

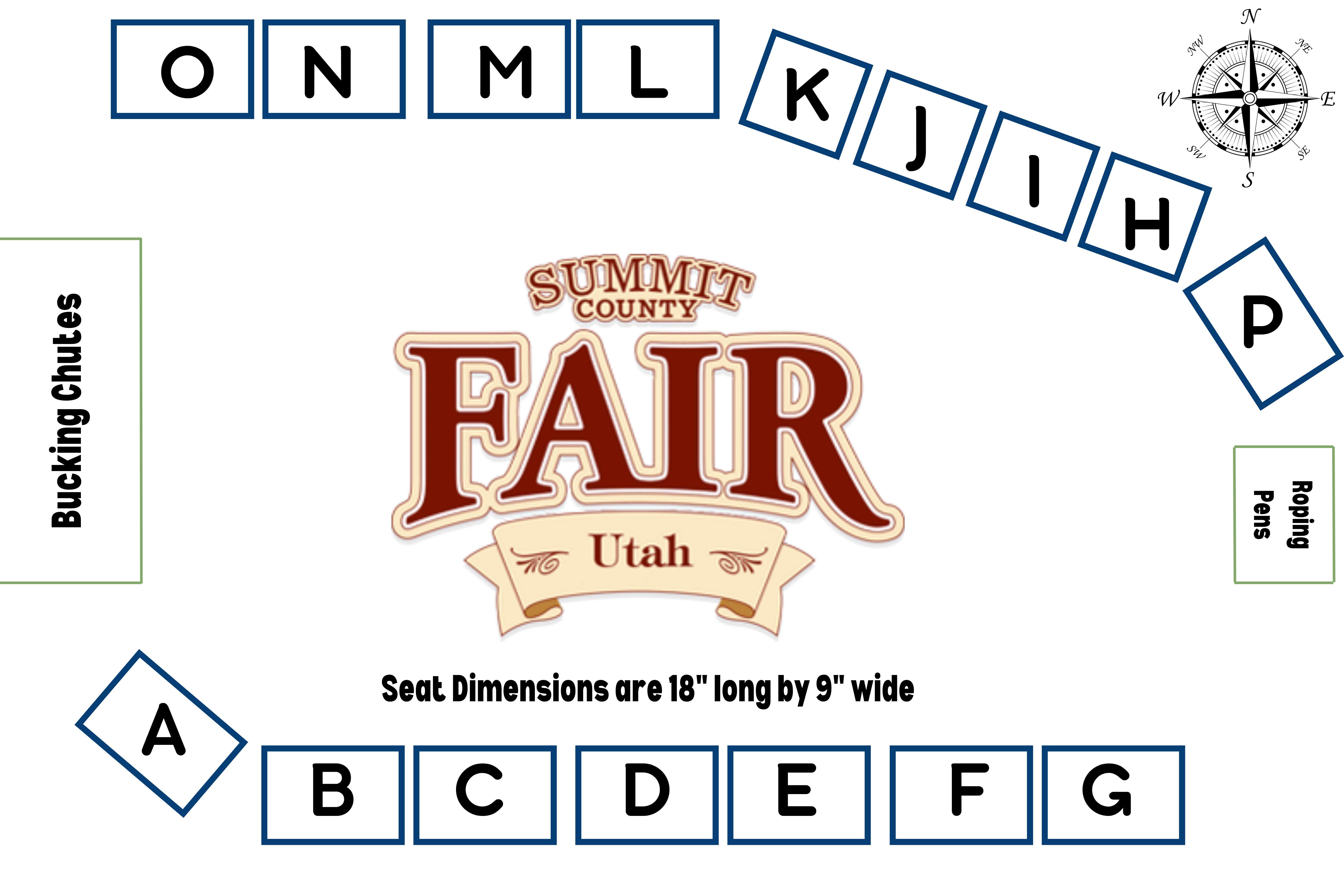

Demolition Derby Summit County Fair

String Of Car Thefts Reported Throughout Summit County Townlift Park City News

Summit County Sales Tax Revenues Show Continued Economic Comeback In Wake Of Covid Parkrecord Com

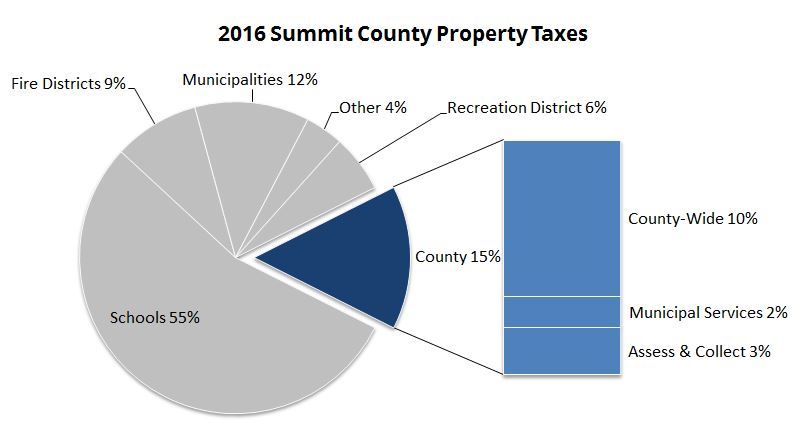

Your 2018 Summit County Utah Property Taxes Explained Park City Real Estate Agent Nancy Tallman

Your 2018 Summit County Utah Property Taxes Explained Park City Real Estate Agent Nancy Tallman